Fleek Network Testnet: Everything You Need to Know

The Fleek Foundation presents an introductory brief of the testnet plans for the Fleek Network, as well as the current high level thinking regarding the economics of the protocol on which the network is based.

Everything in this document is to be considered a first draft, subject to change based on the data and feedback collected throughout all phases of testnet. The purpose of sharing a first draft is to provide clarity to prospective node operators and developers interested in participating in any pre-mainnet activities.

The goal is for the Fleek Foundation, Fleek Labs, and the community of potential network users and other participants to work collaboratively to finalize these details and implement the network launch after the final testnet phase.

Navigate this article:

- Initial Testnet: Phase 0

- Hardware/Node Requirements for Phase 0

- Road to Mainnet: Phases 0-5

- Testnet Participation

- Resource Pricing

- The FLK Token

- Algorithmic Economic System

- Protocol-owned Liquidity

- FLK Token Distribution

Initial Testnet: Phase 0

The official launch of the Phase 0 alpha testnet will be Tuesday September 5th. We will release more detailed information regarding Phase 0 next week before the official launch, as well as tools to improve the onboarding experience. For those that are curious and eager to prepare, you can check out the Github.

Hardware/Node Requirements for Phase 0

For testnet Phase 0, we recommend the following initial setup:

- CPUs that adhere to the x86_64 architecture (64-bit) [Required]

- A minimum of 16GB of memory [likely to increase in future testnet phases]

- Reasonable disk space for installation, estimated at 20GB

These requirements are neither final, nor set, and will be refined based on the metrics and feedback collected during testnet. We encourage trying different setups to help figure out optimal requirements. Starting with a minimum of 16GB is to make participating in Phase 0 more economical while initial loads are smaller, but we anticipate that requirement to increase as testnet progresses. But if your Phase 0 node is struggling, we recommend bumping to 32GB.

Road to Mainnet: Phases 0-5

Fleek Network will utilize a multi-phase approach to rolling out mainnet. The current high level plan, set out below, depends on a variety of factors and may change in response to development timelines and/or data/feedback collected throughout the different phases. Each phase has its own purpose and goals, details of which will be shared prior to the start of each phase. We expect to update the community about any significant changes to the below plan in advance, to the extent we can:

- Phase 0 (September 5th): Node Rollout

- Initial network and node testing (performance, hardware specs, clustering, costs, metrics, etc.)

- Phase 1 (mid-late September): SDK/Service Rollout

- Introduce the SDK and test the building and utilizing of services on the network, as well as some optimizations based on Phase 0.

- Phase 2 (October): Initial Economics Rollout

- Introduce and test a more concrete version of the economic algorithm, including staking, pricing, and other elements/situations using test (valueless) tokens, as well as some optimizations based on Phase 1.

- Phase 3 (November): Layer 2 Contracts Rollout

- Introduce a test version of the aspects of the protocol that will live on an Ethereum L2 (staking, deposit and token contracts, communication between L2/FN, etc).

- Phase 4 (December): Final Rollout

- Introduce the final form of the first generation of the network, based on all data/feedback and optimizations throughout all the phases, and allows testing of what a realistic mainnet environment will be like.

- Phase 5 (Q1 2024): Mainnet Launch

The goals for all stages involve completing and revising the following:

- Network performance

- Hardware/node specs

- Sandboxing of services

- Packaging and pricing of initial network resources/commodities

- Parameters related to the FLK token

- Security testing/auditing

- Criteria for allocation of pre-mainnet community tokens

Testnet Participation

For those interested in participating in any testnet phases or pre-mainnet activities, below are a few Fleek Foundation initiatives that are important to consider:

- 1% of the Total FLK Token Supply is allocated for the pre-mainnet community

- The exact allocation of that 1% to node operators, service builders and users has not been determined at this time. That will be determined closer to the launch of mainnet. A criteria/point system will likely be used to ensure any distributions are based on what brings value, and to leave out sybil attackers or airdrop farmers, similar to how many other projects are currently doing airdrops.

- Reputation Score Building

- Nodes will be able to begin building their reputation during testnet. That reputation can be carried over to mainnet, which is important because work in the network is allocated to nodes primarily based on the nodes’ reputation.

- FLK Node Purchase Program

- For certain node operators who perform well during the testnet, the Foundation (through a subsidiary entity) may allow these operators to buy FLK tokens directly prior to, or just before, mainnet launch so that they have the tokens they need to participate and so that there will be good node coverage at mainnet launch. Any such offer would be made separately and only to node operators who are non‐U.S. Persons located outside of the United States.

- FLK Grants

- An additional portion of the total FLK token supply is expected to be reserved for grants/airdrops (tentatively, 20%). Additional grants may be made by the Foundation during testnet to specific node operators, service builders and/or users on a case-by-case basis for building meaningful features for the ecosystem. The Foundation will provide further information on the grant proposal process at a later date.

Resource Pricing

To start, Fleek Network only plans to charge for bandwidth and CPU cycles consumed. Pricing will be set at the network level, and resources will be priced and paid for in USD denominated stablecoins. The exact pricing methodology will be determined and finalized throughout the testnet phases based on different factors. Those factors include:

- Cost data the Foundation collects from node operators during testnet

- The final specs of the SDK (which will determine what data the protocol can verifiably collect from nodes and reliably charge for)

Please be aware, there will be no fees paid during any of the testnet phases, the above is solely for illustrative purposes to give nodes a better understanding of the current thinking and what the process to finalize resource pricing might look like. We will work collaboratively with node operators throughout testnet to fairly determine resource pricing to ensure appropriate node incentivization while offering competitive pricing to developers.

It’s also important to note that node operators are independent of the Foundation, the network, and each other. They are responsible for managing their own economics, including any taxes payable in any jurisdiction relevant to them due to their participation in the network.

The FLK Token:

FLK is a staking token that is an integral part of the Fleek Network. Nodes running the Fleek Network client software are required to obtain and stake FLK in order to participate in the network and to have the opportunity to earn fees for providing work. Below is some high-level information on the anticipated characteristics of the FLK token:

- Stake amount per node is set/managed at the protocol level, and consistent across all nodes

- Work is allocated based on location (latency) and reputation (performance)

- Resources on the network are priced and paid by users in USD denominated stablecoins

- Pricing of resources happens at the network level.

- Nodes only receive rewards related to work they perform, based on resources used/consumed (including FLK rewards)

- FLK rewards are paid out per epoch (~24 hours). The FLK reward pool for each epoch is split proportionally between nodes who performed work during that epoch, calculated by the amount of USD revenue each node earned compared to the total revenue earned during that epoch.

- 20% of the total FLK token supply is set aside for staking/rewards. The actual rate of rewards/inflation will be algorithmically controlled and updated based on network usage and other factors such as market price of FLK.

DISCLAIMER: All information in this post about the FLK token and other elements of the Fleek Network is being provided solely for informational purposes and does not constitute an offer to sell FLK tokens, or a request for such offers, in any jurisdiction. There are currently no plans to sell FLK tokens. If FLK tokens do become available, you should not rely on the information in this blog post in making purchasing decisions, as the blog post was not prepared for that purpose and there will be important additional information to consider. In addition, we will likely publish further blog posts with updated information about the platform launch.

ALTHOUGH THERE ARE NO PLANS TO SELL FLK TOKENS AT THIS TIME, FOR THE AVOIDANCE OF DOUBT, IF FLK TOKENS EVER WERE TO BE SOLD, THEY WOULD BE OFFERED FOR SALE ONLY OUTSIDE OF THE UNITED STATES TO NON‐U.S. PERSONS, PURSUANT TO THE PROVISIONS OF REGULATION S OF THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”). THE OFFER AND SALE OF FLK TOKENS WILL NOT BE REGISTERED UNDER THE SECURITIES ACT, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS.

Algorithmic Economic System

The TLDR of the current implementation being discussed is that the network will handle the economic system/inflation algorithmically, using a concept we are calling NME, which stands for [N]et present value (npv) [M]arket price [E]quillibrium.

The algorithmic economic system has several goals, listed below in order of priority:

- Provide an opportunity for receiving consistent blended earnings to node operators based on their work in most market conditions

- “Blended” means taking into account both the USD stablecoin fees that nodes are earning, as well as the FLK rewards they are earning (including factoring in the time-weighted average market price of FLK).

- This means if network usage/revenue increases, FLK rewards will likely decrease, and vice versa. This also means that if the time-weighted average market price of FLK increases, nodes should reasonably expect that the amount of FLK rewards will decrease, but the value of FLK rewards received (in USD terms) will remain approximately the same.

- Don’t overcompensate nodes, especially in times of market volatility

- If the market price of FLK deviates from the NPV calculated in-protocol based on time-weighted average protocol-level revenue, nodes should reasonably expect that FLK rewards by number would be reduced.

- Keep the network economy in equilibrium in most market conditions

- Provide better incentives to node operators that are long-term aligned

The algorithm driving the above system will run autonomously in-protocol. However, we anticipate that certain parameters of the algorithm may be treated as parameters that can be adjusted/updated with a network governance proposal, as needed. We currently anticipate that the parameters that can be adjusted will be:

- Maximum FLK inflation/reward rate

- Resource pricing (bandwidth, compute, etc.)

- Average cost of running a node

- Target node margin rate

- Stake amount (# of FLK) per node

- Discount rate

- Time-weighted average market price of FLK

- Maximum stake lock time

- Stake lock multiplier

Protocol-Owned Liquidity

In addition to the in-protocol algorithmic network economic system, the DAO/protocol will also manage 5% of the FLK token supply, which we anticipate will be set aside specifically to allow the community to take certain actions intended to provide long-term benefits to the network’s ecosystem and to help maintain the intended balance in the network economy. It will behave based on predetermined conditions and rules that are publicly auditable. The high level function would be the following:

- Set limit asks to sell tranches of FLK tokens at different price levels in the event of a market price increase that deviates from NPV

- Set limit buys to buy FLK tokens in the event of a price decrease where market price is lower than the current NPV

Benefits:

- Helps keep the economic system in equilibrium by using protocol owned FLK inventory to absorb volatility

- Generates additional revenue for the protocol by capturing fees related to these activities

- Provides better liquidity for node operators who might want to liquidate a portion of their FLK rewards

- Smooths out volatility/price changes in periods of extreme market fear/greed

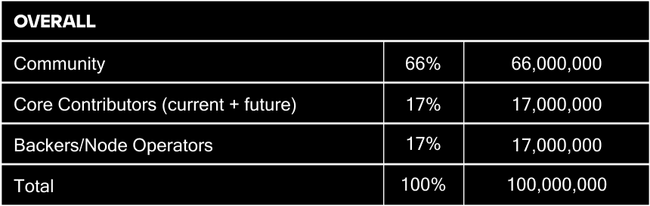

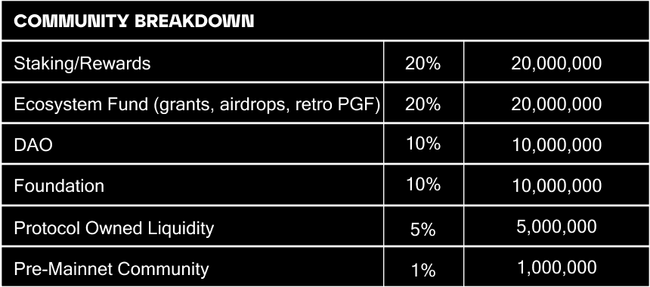

FLK Token Distribution

The following is an initial rough draft of the potential FLK token distribution, subject to adjustments or revisions.

Overall Distribution

Community Distribution

As a reminder, all information presented above is not final, and is subject to debate, change, and input from both the testnet results/metrics and the Fleek Network community. The Fleek Foundation is open to all inputs, and welcomes the community to share thoughts or ideas via Fleek Network’s communication channels (Discord, Twitter).

The Fleek Foundation and Fleek Labs are excited to kick-off the network’s testnet phase and begin collaborating with the community on the Road to Mainnet.

Fleek Foundation ⚡

Find us on Twitter

Join our Discord